Retiring years Not So Golden

Retirement was a given at one time in our life, and we eagerly anticipated the final chapter after years of working hard.

While some people might choose to stay in the workforce a while longer, many look forward to leaving the daily grind of going to work.

But in today’s world, enjoying one’s dream of a golden year work-free has become an unattainable dream for many.

According to a Northwestern Mutual study, nearly 8 in 10 Americans are extremely or somewhat concerned about affording a comfortable retirement.

Here are some of the cause that is impacting our ability to retire comfortably in our retirement years.

Life expectancy is longer.

People are living longer due to the rapid advancement in modern medicine. Our lifespan has been extended by some 30 years, and according to Danielle Roberts, a Medicare expert and co-founder of Boomer Benefits, this means we boomers have to save for a longer lifespan in retirement,

Danielle Roberts says, “Our retirement savings must factor in housing expenses, utilities, lifestyle, and healthcare costs, which many Americans just aren’t prepared for financially by the time they reach 65”

Education Costs More

Another big reason retirement is more challenging now than prior generations is higher education’s spiraling cost.

And many boomers have prioritized paying for putting their kids through the college of their choice over their retirements.

And this also includes student loans; with the cost of education getting higher, students are likely to apply for a student loan.

And parents are sharing in this cost by taking on this debt either in part or in full, so saving for retirement is put on the back burner.

Social Security

With the cost of living increasing, the money we get from our social security is insufficient. With the constant rumor that social security will soon end, it is best to put too much emphasis on social security when thinking about retirement.

Part-Time Income Earner

It is always a good idea to have an extra source of income whenever possible, as this extra income will allow you to pay down your debt and allow some savings.

But it would help if you remembered that these earning sources usually do not have any retirement benefits, so we need to look out for ourselves; we have to take all the necessary steps to ensure our retirement is comfortable.

If you are a few years from retirement and need to add some security to your retirement account, I recommend looking into owning your own business.

Online Marketing

Online Marketing is one of the best ways to earn a good income without any hassles accompanying owning a physical business.

Online marketing is cost-effective (you can become a member of one of the best training platforms for free here)

There is no keeping of inventory. No shipping, no return to handle, no customer service, there is none of the usual headaches of owning a brick-and-mortar business,

Just in case you are unsure what online marketing is, here is the meaning from Wikipedia.

Affiliate marketing is performance-based marketing in which a business rewards one or more affiliates for each visitor or customer brought about by the Affiliate’s marketing efforts.

But before you earn money, you will need to create your niche website and work to get traffic.

Without a website, content, and traffic, the MONEY part doesn’t happen. And because of this fact, I would like to tell you about Wealthy Affiliate.

Wealthy Affiliate

Wealthy Affiliate is (in my opinion) one of the best training platforms. Still, this platform is not only for training but for every online marketer, whether you are new to affiliate marketing, have some knowledge about affiliate marketing, or are a super affiliate marketer (making over $7000.00 per month.)

At Wealthy Affiliate, you will be taught how to transform your passion, hobbies, or ideas into a profitable business,

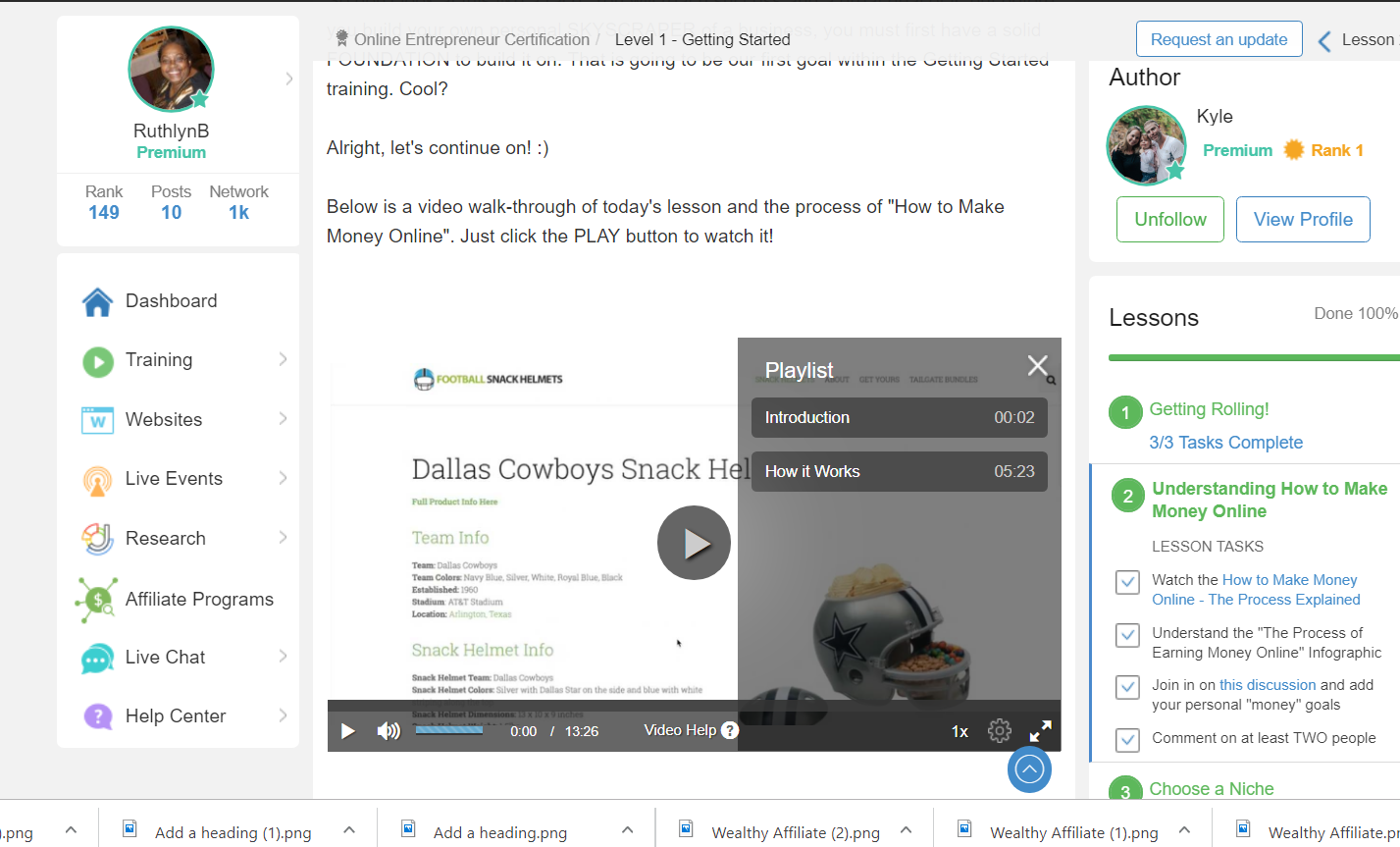

Here is a video on How to make money online; this is lesson 2 of our ten lessons or phase 1 of the best training course, which is available to you when you become a free member.

Being a free member, you have access to two websites and 12 themes to choose from for your websites.

You will have a beautiful-looking, mobile, and revenue-ready website at the end of these ten lessons. State-of-the-art, ultra-powerful, and secure hosting will allow you to grow your business.

Premium Membership

There is also the premium membership, and I would encourage you to upgrade to the premium membership. The premium membership has so much more to offer; there are more opportunities for many more income streams.

Yes, being a premium member does cost, but the cost is well worth it compared to the great tools and information to assist you in reaching your goals.

You can read about Wealthy Affiliate here, and I hope you will see the great value in investing in Wealthy Affiliate to own your own online business.

I am not saying that you can make a lot of money overnight. No affiliate marketing, like any business, takes time.

You will need time to earn the trust of your audience, just like any other business.

And as in any venture, you will need to put in hard work, perseverance, learning, studying, sacrifice, and patience, your business will be successful, but it takes time.

Conclusion

There is no cost to becoming a member of Wealthy Affiliate, and you can become a member to build your website; following the video training it only takes 30 seconds, and see if it is something you could do,

If you can continue, remember there is no expiration date for being a free member, I have seen members remaining accessible for a long time. I do not know just how successful they were in staying a free member.

Wealthy Affiliate has been around for almost 15 years, and the members here are from 193 countries and number about 1.4 million; I invite you to try affiliate marketing; you will never know if you would like it if you do not try.

Free Membership

By joining the free membership, you will not be asked for any financial information; you will only be asked for your name. and email address, so there is no fear of being credited for anything.

Please do not let fear of the unknown keep you from experiencing the feeling of owning your own online business.

I understand the fear, and I also had that fear; I was a senior in my 70s who had no prior knowledge of online marketing and no computer skills.

But the training videos are done, so you do the lessons at your own pace. And the videos are always available for you to revisit at any time.

There is also a community made up of like-minded people who are willing to assist you in any way they do; in this way, you will never be alone; there is always someone around to help you.

So why not give it a try? You have nothing to lose and a lot to gain. And you can become a free member by clicking on any of the links in this post, and I will be your coach.

Thank you for reading my post; I really appreciate it, and if you have a question or a comment, please leave it in the space provided at the end of this post, and I will reply ASAP; please remember to share this post. Thank you.

NOTE: This post includes affiliate links, which, if clicked on and a product purchased, I get a small commission (with no increase in cost to you).

I appreciate your site. Very similar in nature to mine. As we are in our senior years, I’m still working, but will never retire if I don’t do something to create a cushion. Great site…I look forward to watching it grow.

Thank you, Beth, for your comment, unfortunately, I was forced to retire, because of an accident that left me slightly disabled, but I am thankful that I am given the opportunity to make some money to assist in my living expenses. Thank you for your comment and I wish you success in your business.

I am a millennial and one of many that never thought about saving until I was 30. My wife was very concerned and she helped me get my act together when it came to my finances. And many of the points you mentioned above were also her biggest fear.

I can’t stress enough how much having a passive income source helped with getting my financial act together. I too started a blog and bring in money each month that goes directly into our savings account and gets invested. The stress relief from the side income is incredible.

Ben, I am so happy you have taken the approach to start saving at the age of 30, unfortunately, in my former job as a CNA I have seen s many seniors with nothing saved and no family, I am fortunate to have this experience to make some extra money to assist me as I myself do not think I have enough saved. It is my hope that more seniors take the opportunity to start their own business. Thank you so much for your comments and I do wish you all the best. I

Ben, interesting topic here indeed. I didn’t even consider saving my money until my mid twenties after reading some investing books by some of the all time wealthiest people who all funnily enough started saving as soon as they entered the work force. You definitely hit the nail on the head with this one my friend.

All the best.

Thank you so much for your comment, I think it is awesome that you started saving n your twenties, I wish the younger generation would take this step and not wait until they are nearing retirement to start saving, I am afraid that would be too late. Wishing you success.